AFL member number ladder 2025: AFL club subscription because of the people, club details, very people, Collingwood pips West Shore since the Brisbane and you may Gold Coast rise

Det Bedste Online On Line Casino I Danmark

14 octubre, 202510 für nüsse inside Registration im Slotty Way Spielbank, 200% Prämie

14 octubre, 2025AFL member number ladder 2025: AFL club subscription because of the people, club details, very people, Collingwood pips West Shore since the Brisbane and you may Gold Coast rise

Content

Originating in 2022, range step 1 is lengthened and there try the new traces 1a due to 1z. Unique regulations to own qualified progress invested in Licensed Options Finance. When you yourself have a qualified acquire, you can purchase one to gain to your a qualified Chance Fund (QOF) and choose to put off area otherwise the acquire one to is actually or even includible inside the earnings.

Lender Added bonus Each week Bond – Week of Oct twenty four, 2023

But, if you satisfy the standards, accredited withdrawals (chatted about later) is actually tax free. You could exit numbers in your Roth IRA so long as you reside. The fresh tax on the early withdrawals cannot affect the fresh part of a shipping you to definitely represents a profit of your nondeductible efforts (basis). Federal taxation is withheld from withdrawals out of antique IRAs until you select to not have income tax withheld.

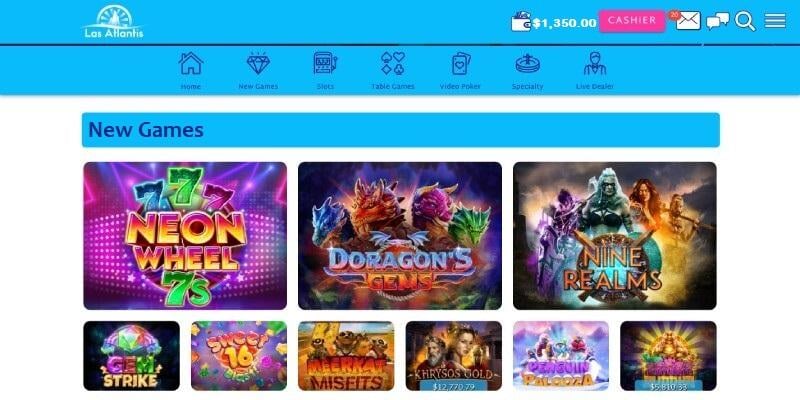

Best $step one Minimum Deposit Casinos Oct 2025

Progressive jackpots in the cellular casinos such Regal Vegas allow this reduced entry point, providing people an opportunity to victory a real income. Gambling establishment ratings have a tendency to focus on such casino operators that offer reload bonuses, increasing the interest of these seeking to purchase minimally in the on the internet casino games. Casey and you will Pat Hopkins document a combined go back for the Setting 1040 to own 2024. Casey is retired and you will obtained a fully taxable pension from $15,five-hundred. Casey in addition to received social security professionals, and Casey’s Mode SSA-1099 to have 2024 suggests internet great things about $5,600 within the package 5.

You can’t deduct travelling expenditures no matter how much your home is from your typical workplace. You could’t deduct commuting expenses even though you works within the travelling travel. For those who focus on a couple of cities within the a day, even though for zerodepositcasino.co.uk look here similar boss, you could potentially subtract the price of getting in one office so you can one other. Although not, if for most private need your wear’t go directly from one to spot to another, you could potentially’t deduct more the quantity it could provides charge you to visit right from the original spot to the following. That it section covers costs you might deduct for team transport whenever your aren’t take a trip on the run, since the defined inside part step one.

- Incidental functions, such as typing cards otherwise assisting within the entertaining customers, aren’t enough to make the expenses allowable.

- Wagering requirements depend on a parallel of your extra number.

- You happen to be able to subtract the price of transferring to your tax household as the a moving debts.

- They’re degree and you can registration costs to have number one elections.

- An internet casino often matches a share of one’s put right up so you can a specific amount with this added bonus.

- Though it is only relative quick extra you’re still able to win a significant amount of cash.

You have got wages out of $7,100000, focus money from $five hundred, a business loss of $step three,100000, without itemized write-offs. You utilize Dining table 10-3 to find the product quality deduction amount. You enter into $4,100 ($7,one hundred thousand − $step 3,000) on line step 1, and include outlines 1 and you can 2 and get into $4,450 ($4,one hundred thousand + $450) on the web step 3. On line 5, your enter into $4,450, the bigger of traces step 3 and you will cuatro, and you may, because you are single, $14,600 on the internet 6. On the internet 7a, you go into $4,450 because the simple deduction amount because it’s smaller than $14,600, the amount on line 6. When you have money in addition to their benefits, you may have to document an income whether or not none away from the benefits is taxable.

Of numerous NZ casinos offer 100 percent free revolves or jackpot opportunity for because the nothing while the $1, providing you with access to real cash play. Since the probability of an enormous win is actually straight down (as you don’t get of several spins with for example lower amounts), even brief bets can still deliver fascinating earnings which have a bit of luck. Just remember to ease gambling on line while the amusement, much less a method to make monetary gains. For many who’ve stated this type of also provides currently, we have listed most other low minimum put local casino offers thereon independent web page. The fresh playersNo put incentives give you the chance to wager free rather than risking your finance.

For individuals who must tend to be any amount on your revenues, you may have to improve your withholding otherwise make projected taxation payments. Enter the total distribution (just before tax or other deductions have been withheld) for the Form 1040 or 1040-SR, range 4a. It count will likely be found inside the field step one of Form 1099-R, Distributions Of Pensions, Annuities, Later years or Money-Discussing Plans, IRAs, Insurance Deals, etc. From this count, subtract one efforts (constantly found inside field 5 out of Setting 1099-R) that were taxable for your requirements whenever generated.

To possess 2024, commission credit enterprises, percentage apps, an internet-based opportunities will be required to send your a form 1099-K if level of your business deals inside the 12 months is over $5,one hundred thousand. In the season 2025, the new threshold often all the way down so you can over $dos,500; and 2026 and later ages, the newest endurance will be more than just $600. For here is how to help you report expenditures on the tax return, find Self-working early in that it part.

Instructor Costs

Bailey provides health and you may medical expenditures away from $600, that you spend in the season. You help a not related pal as well as your friend’s step three-year-old man, just who resided to you all-year of your house. The pal does not have any revenues, actually needed to file a great 2024 tax go back, and you will does not document a good 2024 tax come back. This is especially valid if your being qualified man is not a qualifying man from anybody else but your spouse which have the person you package to document a shared return.. The new noncustodial mother must install a copy of the mode or declaration on their tax go back. The brand new custodial mother or father or other taxpayer, if the qualified, is also claim the little one on the made earnings borrowing.

As is most likely obvious, getting a good 9 shape contribution is over all of us you are going to ever desire to earn and you can, arguably, more we might actually you need. Even a good 9 profile web worth is quite wild, aside from generating 9 figures within the money every year. Nine rates is actually a range ranging from one hundred,one hundred thousand,100000 and you may 999,999,999, because the each one of these have nine digits. This will imply that people earning a great 9 contour income create getting getting between $a hundred million and simply below $step one billion. Meanwhile, we’ve all of the heard the newest reports of people searching by themselves for the mountains from personal debt also at that number of income.