Understanding Online Casino Tax Laws A Comprehensive Guide -1475160623

Discover the Universe of Fun with CosmicSpins

7 enero, 2026Купить диплом в Саранске качество и надежность

7 enero, 2026Understanding Online Casino Tax Laws A Comprehensive Guide -1475160623

Understanding Online Casino Tax Laws: A Comprehensive Guide

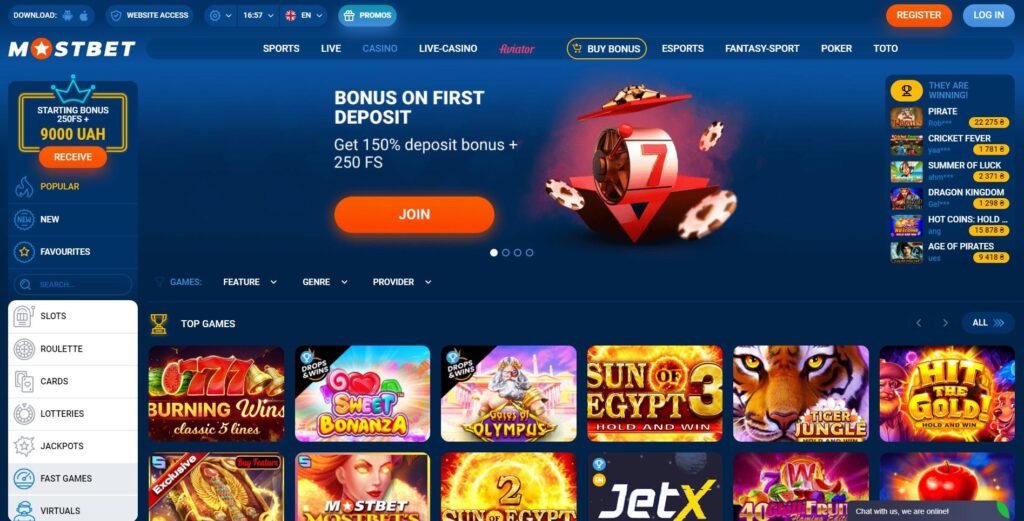

As the popularity of online casinos continues to rise, so does the importance of understanding the Online Casino Tax Laws in Bangladesh: What You Need to Know Mostbet register legal landscape that governs them, particularly concerning tax laws. Different countries and regions have varied approaches to how they regulate and tax online gambling activities. This guide will explore the different frameworks, obligations, and nuances involved in online casino tax laws across various jurisdictions, offering insights for both players and operators.

The Evolution of Online Casino Tax Laws

Online gambling has experienced exponential growth since the late 1990s, prompting many governments to revisit and revise their tax laws associated with it. Initially, many nations were slow to respond to the digital gambling wave, resulting in a patchwork of regulations that often left significant gaps. However, as the online casino industry matured, regulators began to establish clearer frameworks aimed at ensuring fair taxation while also protecting players.

Understanding How Online Casino Taxes Work

Taxation on online gambling can be complex, primarily because of the different types of taxes that may apply. Here are the key categories generally observed:

- Gaming Taxes: These are imposed directly on the revenue generated by online casinos. They can significantly differ based on jurisdictions, ranging from fixed amounts to percentages of gross gaming revenue.

- Income Taxes: Players often face income tax on their winnings. While this may seem straightforward, the specific obligations can vary based on local laws and players’ residency status.

- Value Added Tax (VAT): In some regions, online gambling may also be subject to VAT, which adds another layer of complexity.

Jurisdictional Variations in Tax Laws

Online casino tax laws are highly variable and depend on the jurisdiction in which the online casino is operating as well as where the players are located. Here are a few examples:

United Kingdom

The United Kingdom has a well-established framework for online gambling, where operators must pay a gaming duty of 21% on their profits. Players’ winnings are generally tax-free, which encourages participation. The UK Gambling Commission regulates online casinos, ensuring compliance and fairness.

United States

The U.S. presents a much more fragmented approach due to its federal structure. Online gambling laws and taxes vary greatly from state to state. While states like New Jersey and Pennsylvania have embraced online casinos and implemented specific tax rates (typically between 15-20%), other states still prohibit online gambling, leaving a patchwork of regulations to navigate.

European Union

In the European Union (EU), taxation of online gambling is governed by individual member states. Some countries, like Germany, have introduced strict regulations and taxes that can reach up to 20% of revenue, while others, like Malta, have more favorable tax regimes that attract many operators. The variance creates a competitive landscape where players and operators must be well-informed.

Tax Obligations for Online Casino Operators

For online casino operators, understanding their tax obligations is crucial to maintaining compliance and ensuring profitability. Generally, operators need to:

- Register with local regulatory authorities and obtain the necessary licenses.

- Keep detailed records of all financial transactions, including player deposits, bets, and winnings.

- File regular tax returns and ensure timely payments to avoid penalties.

Failure to comply with tax regulations can lead to hefty fines and even the revocation of licenses, emphasizing the importance of adhering to local laws.

Tax Implications for Players

Players must also be aware of their tax liabilities concerning gambling winnings. While many jurisdictions do not tax smaller winnings, larger payouts can trigger income tax responsibilities. Here are a few considerations for players:

- Check local laws regarding taxation of gambling winnings, as this varies widely.

- Maintain records of all gambling activities for tax reporting purposes.

- Consult with tax professionals to ensure compliance, especially for high-stakes players.

The Future of Online Casino Tax Laws

As technology evolves and online gambling becomes more widespread, it’s likely that tax laws will continue to develop. Governments are increasingly recognizing the potential tax revenue from online gambling and may introduce more streamlined and user-friendly regulations. Moreover, as international players become more involved, jurisdictions will face pressure to harmonize their laws to ensure fair competition.

In conclusion, the landscape of online casino tax laws is rich and varied. Both operators and players must navigate this complex environment with care to understand their obligations and rights. By staying informed and compliant, stakeholders in the online gambling industry can ensure a fair and profitable experience for all involved.