Choosing the Right Forex Currency Trading Broker 1819149766

A Comprehensive Guide to the Astrozino Casino Registration Process 1951196000

3 noviembre, 2025Diflucan doza 400 mg Sve što trebate znati za učinkovito liječenje

3 noviembre, 2025Choosing the Right Forex Currency Trading Broker 1819149766

Choosing the Right Forex Currency Trading Broker

When venturing into the world of currency trading, selecting a trustworthy forex broker is paramount. The forex market is one of the largest and most dynamic financial markets in the world, and having the right broker can make all the difference in your trading success. A well-established broker like forex currency trading broker protradinguae.com can provide essential support and services to help you navigate this complex environment.

Understanding Forex Brokers

Forex brokers serve as intermediaries between traders and the forex market. They provide access to trading platforms where individuals can buy and sell currency pairs. Different brokers offer varying degrees of customer service, trading platforms, and account types, which can significantly influence a trader’s experience. The primary role of a broker is to facilitate trades and, in some cases, provide tools, resources, and research to enhance the trading experience.

Types of Forex Brokers

Forex brokers can generally be categorized into three types: market makers, STP (straight-through processing) brokers, and ECN (electronic communication network) brokers. Each type has its mechanisms for executing trades and may offer different advantages and disadvantages.

- Market Makers: These brokers provide liquidity by creating a market for their clients. They often quote their own prices and might earn from the spread between the buying and selling prices. While they can offer favorable trading conditions for beginners, they also may come with potential conflicts of interest.

- STP Brokers: STP brokers process orders directly to liquidity providers without the intervention of a dealing desk. They typically offer variable spreads and cater to a range of traders, including scalpers and day traders. Transactions are executed at the best available market price.

- ECN Brokers: ECN brokers connect traders directly with other traders or institutional participants. They generally offer raw spreads and low latency, making them suitable for experienced traders who seek transparency and high-frequency trading opportunities.

Choosing the Right Broker

Selecting the right forex broker involves several critical factors. Here are the key considerations to ensure you make an informed choice:

1. Regulation and Trustworthiness

First and foremost, it’s essential to choose a broker that is regulated by a reputable authority. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, enforce standards to protect traders. Always check the regulation status of the broker to minimize the risk of fraud.

2. Trading Costs and Fees

The cost of trading can significantly impact your profitability. Pay attention to the spreads, commissions, overnight fees, and any other associated costs that a broker might impose. A transparent fee structure can help you avoid unexpected costs.

3. Trading Platform and Tools

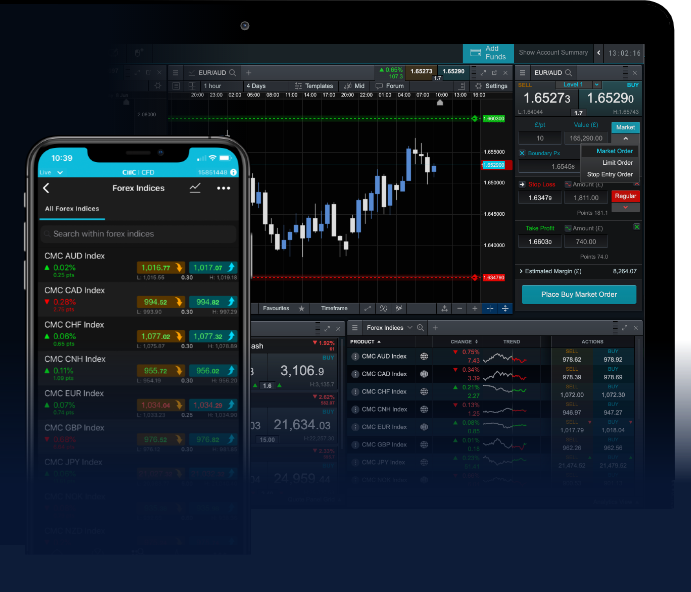

The trading platform is an integral part of your trading experience. It should be user-friendly and equipped with essential trading tools and features like advanced charting, technical indicators, and automated trading options. Make sure to check reviews of the broker’s platform before making a decision.

4. Leverage Options

Different brokers offer various levels of leverage, which can amplify your profits as well as your losses. Understand how leverage works and choose a broker that offers leverage suitable for your risk tolerance and trading strategy.

5. Customer Service

Efficient customer service is crucial, especially for traders who may require assistance at any point. Look for a broker that provides multiple channels of communication and responsive support. Good customer service can enhance your overall trading experience.

The Benefits of Using a Forex Broker

Using a forex broker presents numerous benefits to traders of all levels. Here are some advantages of trading through a broker:

1. Access to Markets

Forex brokers provide access to a wide range of financial instruments and markets. This allows traders to diversify their portfolios and spread risk across various currency pairs.

2. Trading Tools and Resources

Many brokers offer educational materials, analysis tools, and research that can empower traders to make informed decisions. From economic calendars to webinars, these resources can enhance your trading knowledge and expertise.

3. Practice Accounts

Most reputable brokers offer demo accounts that allow traders to practice risk-free trading. This is a valuable opportunity to familiarize oneself with the trading platform and test out strategies before engaging with real funds.

4. Risk Management

Forex brokers often provide risk management tools such as stop-loss and take-profit orders. These can help traders protect their investments from significant losses while letting them capitalize on potential gains.

Tips for Successful Trading

Choosing the right broker is just the first step. To achieve success in forex trading, consider the following tips:

1. Develop a Trading Plan

Having a well-structured trading plan is essential for managing your trades effectively. Outline your goals, risk tolerance, and the criteria for entering and exiting trades. Stick to your plan to avoid emotional trading.

2. Stay Informed

The forex market is influenced by economic indicators, geopolitical events, and global developments. Keeping abreast of news and analysis can help you adjust your trading strategies accordingly.

3. Practice Patience

Successful trading requires patience and discipline. Avoid the temptation to overtrade or chase losses. Set realistic expectations and give yourself time to develop your trading skills.

4. Monitor Your Emotions

Trading can evoke strong emotions like fear and greed. It’s important to recognize these feelings and manage them effectively. Utilize your trading plan to maintain discipline during trading sessions.

Conclusion

In conclusion, choosing the right forex currency trading broker is a critical step toward success in the forex market. By considering factors such as regulation, trading costs, platform reliability, and customer service, traders can make informed decisions that align with their trading goals. With the right broker by your side, coupled with effective trading strategies and risk management, you can navigate the complexities of forex trading and work towards achieving your financial objectives.