The Ultimate Guide to Forex Trading Software 1689775188

Rokubet Bahis Ve Casino Sitesi»

28 octubre, 2025Esteroides y Edad: Riesgos para Jóvenes

28 octubre, 2025The Ultimate Guide to Forex Trading Software 1689775188

The Ultimate Guide to Forex Trading Software

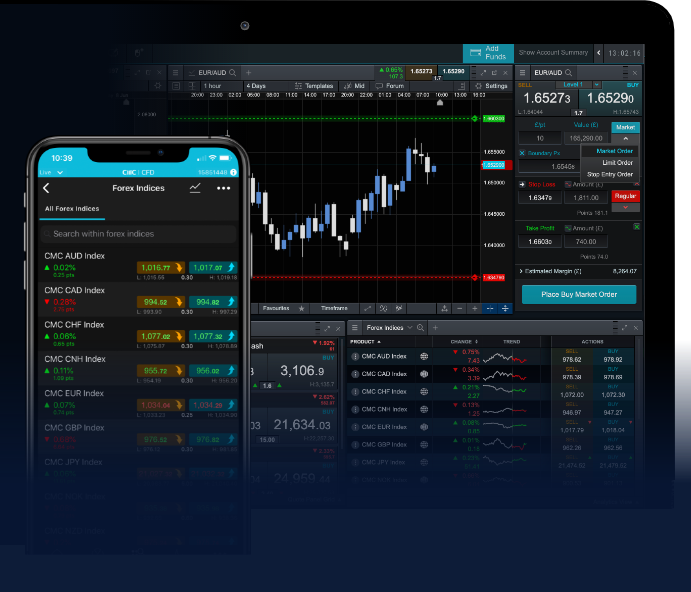

Forex trading has become increasingly popular over the years, with more individuals looking to take advantage of global currency movements. To succeed in this dynamic market, traders often turn to various Forex trading software solutions that promise to enhance their trading experience. In this guide, we will delve into the types of Forex trading software available, their features, and how to choose the right one for your trading needs. For those interested, resources like forex trading software https://exbroker-argentina.com/ offer valuable insights into the tools and platforms available.

Understanding Forex Trading Software

Forex trading software facilitates the trading process by providing tools and functionalities that help traders analyze markets, place orders, manage trades, and automate strategies. This software varies widely, ranging from simple charting tools to comprehensive platforms that offer algorithmic trading capabilities.

Types of Forex Trading Software

There are several types of Forex trading software that cater to different trading styles and preferences. Below are some of the most common categories:

1. Trading Platforms

Trading platforms are perhaps the most well-known type of Forex software. They provide traders with the tools necessary to execute trades directly on the market. Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer features such as advanced charting tools, technical indicators, and user-friendly interfaces.

2. Automated Trading Software (Expert Advisors)

For those who prefer a hands-off approach, automated trading software, commonly known as Expert Advisors (EAs), can be a game-changer. These tools allow traders to set specific parameters and let the software execute trades on their behalf. Automated trading can eliminate emotional decision-making and improve consistency in trading strategies.

3. Signal Providers

Many Forex traders rely on signal providers to supply them with buy and sell signals based on market analysis. Forex trading software can analyze historical data and provide accurate signals to help traders make informed decisions. These services save time and can be particularly useful for novice traders or those who lack the time to analyze the market themselves.

4. Risk Management Tools

Effective risk management is critical in Forex trading, and numerous software solutions are designed specifically for this purpose. Tools that help traders set stop-loss orders, calculate position sizes, and monitor margin requirements can be invaluable in safeguarding capital against excessive loss.

Key Features to Look For

When choosing Forex trading software, certain features can significantly impact your trading effectiveness and comfort level. Here are key features to consider:

1. User-Friendly Interface

A user-friendly interface is crucial, especially for novice traders. The software should be intuitive, allowing users to navigate easily through various functions without feeling overwhelmed.

2. Customizability

Traders have unique styles and preferences, so the ability to customize the software to meet individual needs is essential. Look for features that allow for personalized charts, layouts, and settings.

3. Performance and Speed

In Forex trading, time is money. Software that experiences delays or lags can lead to missed opportunities and losses. Ensure the software is robust and boasts fast execution speeds.

4. Security Features

Security should be a top priority when trading online. Look for software that employs strong encryption methods and protects your personal information and funds.

How to Choose the Right Forex Trading Software

With numerous Forex trading software options available, it can be overwhelming to make a choice. Here are some guidelines to help you select the right software:

1. Identify Your Trading Goals

Before diving into software options, clearly identify your trading goals. Are you a beginner looking for a straightforward platform, or an experienced trader seeking advanced analysis tools? Knowing what you want will streamline the selection process.

2. Test with Demo Accounts

Most reputable Forex trading software providers offer demo accounts. Use these to test the features and functionalities of the software without risking real money. This proactive approach will help ensure you find a platform that suits your trading style.

3. Read Reviews and Recommendations

Before committing to a particular software solution, read reviews and seek recommendations from experienced traders. Their insights can provide valuable information on a platform’s reliability and performance.

Conclusion

In today’s fast-paced Forex market, utilizing robust trading software can significantly enhance your trading efficiency and success. By understanding the various types of software available, identifying key features, and carefully choosing the right solution for your needs, you can navigate the Forex landscape with greater confidence. Always remember to stay informed and continuously seek out resources that can aid your trading journey. With the right tools at your disposal, you can take your trading to new heights!