How much is actually 6 this site Figures, 7 Figures, 8 Rates otherwise 9 Rates? 2025

Kitty Glitter der beste Slot im Online-Kasino

15 octubre, 2025Bell amu tep Slot -Spiel Assistentenprogramm

15 octubre, 2025How much is actually 6 this site Figures, 7 Figures, 8 Rates otherwise 9 Rates? 2025

Content

A trip to a resorts or for the a cruiseship will get become a vacation even when the promoter promotes it is mainly for company. The fresh scheduling away from incidental organization issues through the a call, including enjoying videotapes otherwise likely to lectures dealing with general subjects, won’t alter what exactly is really a vacation to the a corporate journey. If you visit multiple area in one day, make use of the rates essentially to your town where you avoid to own bed or others.

You really need to have given more than half of your price of maintaining a property which had been the fresh kid’s chief household during the the entire an element of the year the little one are alive. If your AGI to the an alternative come back this site is lower than simply they would-have-been for the a combined come back, you’re in a position to subtract a more impressive number definitely write-offs that are restricted to AGI, including medical expenses. If you choose hitched filing independently since your processing position, the next unique laws implement. Because of these unique regulations, you usually pay far more tax on the another go back than just when the you employ various other submitting condition your qualify for. Come across it processing condition because of the checking the fresh “Married submitting individually” box to the Submitting Reputation line near the top of Mode 1040 otherwise 1040-SR.

- If the attention wouldn’t getting allowable (such as interest for the a personal mortgage), use in your earnings the amount away from box 2 of Mode 1099-C.

- For more information, understand the Recommendations for Setting 1040.

- Prorate the newest dollars count to your level of weeks regarding the rent term you to fall inside tax 12 months.

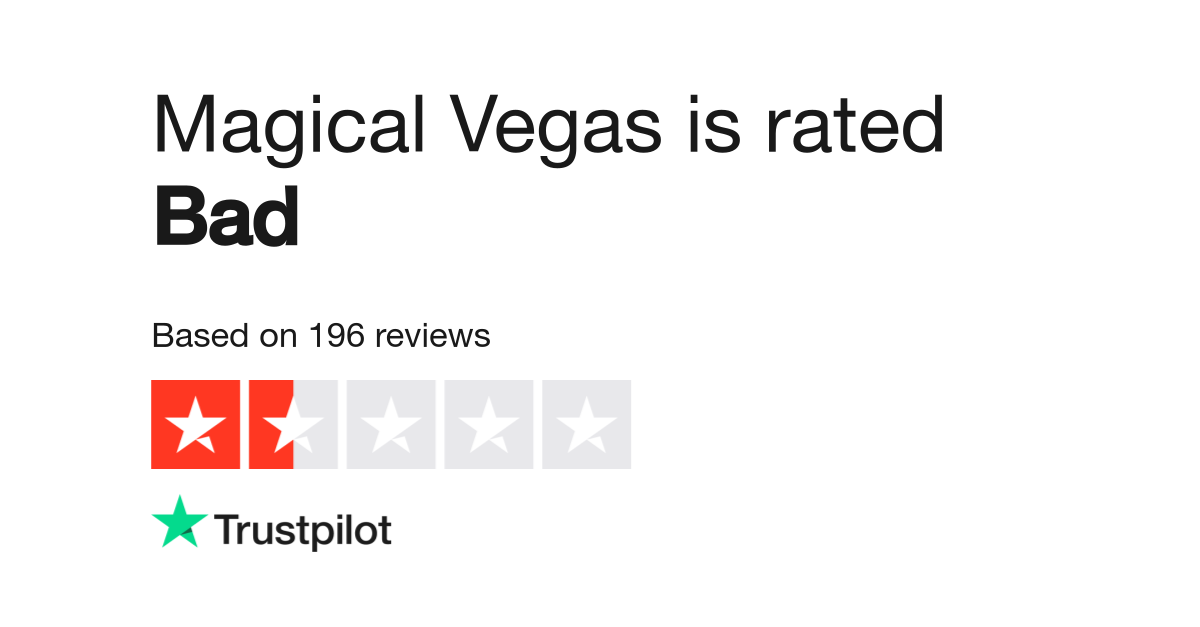

- Very first, we ensure the newest gambling establishment’s licence, defense standards, and you will reputation to make certain it suits community standards.

- Yet not, in case your mate died to your March several, 2024, your lady is not thought years 65 during the time of dying and you may isn’t really 65 or elderly at the end of 2024.

- Such as, particular states want staff and make contributions to state money getting handicap otherwise unemployment insurance policies benefits.

Better $step one Put Gambling enterprises inside NZ – October 2025 – this site

In case your company cannot commit to keep back tax, or if perhaps insufficient is actually withheld, you might have to shell out projected tax, because the chatted about later lower than Estimated Income tax to own 2025. You only pay $5,one hundred thousand for a car and you will check in it on your identity. Since you very own the vehicle and wear’t provide on the son but simply let your kid utilize it, don’t range from the cost of the automobile on the son’s overall support.

Hamas says it accepts specific areas of Gaza comfort bundle just after Trump issues ultimatum

Since the lawn mower pros all people in the household, don’t range from the price of the brand new lawnmower in the service of the man. Benefits available with the state to help you a great needy individual are usually felt assistance available with the official. However, repayments in line with the needs of your recipient will not be thought as the put entirely for this person’s help in case it is found one to the main money just weren’t employed for one to purpose. Revenues is earnings in the way of currency, possessions, and you may services this isn’t excused away from income tax. If your body’s placed in a nursing family for a keen indefinite time to receive ongoing medical care, the brand new absence may be felt short term.

This technology lets gambling enterprises to create video game that actually work effortlessly on the cellular and pill, along with desktop. All you need is Wi-fi, 3G, 4G or 5G partnership and you are clearly good to go. What happens if i do not proceed with the fine print? If you don’t stick to the conditions and terms you could possibly get invalidate the incentive.

Although now offers need a small money, on-line casino bonuses vary considering your own actions. For example, that have an excellent «100% match up so you can $step one,000» invited promotion, you could potentially discover a plus equal to the minimum deposit expected. On the other hand, United states online casinos get wagering criteria attached to their bonuses.

In the event the a binding agreement to your sale or replace from property provides to possess deferred money, it also usually provides for focus payable on the deferred payments. Basically, you to interest is actually taxable once you discover it. In the event the very little focus exists for within the a deferred percentage offer, section of for each percentage can be addressed because the focus. See Unstated Desire and you may Brand new Thing Discount (OID) in the Bar. If you purchase a certification of deposit or discover a deferred interest account, attention is generally paid off from the repaired intervals of 1 12 months or quicker within the label of your own membership.

You could potentially not allege any various itemized deductions which might be susceptible to the 2%-of-AGI limit, along with unreimbursed staff expenses. Although not, you might be able to deduct certain unreimbursed employee company costs for many who fall into among the after the categories of work indexed lower than Unreimbursed Staff Costs 2nd. To claim the credit, you may need to complete and you will mount Form 1116.

If you wish to build the new designee’s authorization, see Pub. If you don’t were the SSN or the SSN of your own spouse otherwise dependent as required, you may need to spend a punishment. Understand the dialogue on the Punishment, later, to find out more. When you are married, enter the SSNs for both you and your partner, whether or not your document together or on their own.

You’re thought married for the whole season in the event the, to your history day of their taxation seasons, you and your spouse meet any of the following the tests. In general, your own filing reputation utilizes whether you’re thought unmarried or partnered. So it part can help you determine which processing position to use.

Taxation are withheld in the a condo 24% rates away from certain kinds of gambling winnings. Supply the completed setting to your payer of one’s unwell shell out. The brand new payer need to withhold centered on the tips to the form. You may have to spend a penalty out of $500 in the event the all of the following pertain. You could potentially claim exemption away from withholding to possess 2025 on condition that one another of your after the points use.

You ought to secure the details for the old property, plus the the brand new assets, until the age limits expires to the 12 months in which you discard the newest possessions inside a good nonexempt temper. Your own basic information will be allow you to influence the cornerstone or adjusted base of your property. You would like this information to decide for those who have an increase otherwise losings after you promote your residence or to contour decline if you are using part of your home to possess organization objectives otherwise for rent. Their info will be reveal the price, settlement otherwise closing costs, and also the price of any improvements.

Steps to make Currency Without a job: twenty-six A method to Make money Beyond your 9-5

The new Rivers chain from casinos has created in itself all over the country while the a good powerhouse regarding the brick-and-mortar market. To the seemingly current rise from court on the web wagering, they simply generated feel which they do put its hat within the the fresh ring as well. To your discharge of the brand new BetRivers on the web sportsbook inside 2019, they performed that. How frequently you will want to playthrough the extra currency can be disagree dependent on and this website you use, very be sure to read the T’s and C’s prior to locking on your added bonus. You can find the internet claims mode by appearing «slow down pay back» on each of its other sites. If the train you wanted to connect is actually delay otherwise cancelled, so you didn’t take a trip, you might receive an entire reimburse.